The NHS missed its threemonth deadline for issuing pension statements to more than 4,000 staff this year as the service struggles to cope with requests from doctors worried about tax billsViews Public service pension scheme consultation response – the McCloud judgment FAQs views What form do I complete to claim my NHS Pension?Pension benefits from the Scheme are calculated using pensionable pay and years and days of membership for members of the 1995/08 Section and using pensionable earnings for members of the 15 Scheme The contributions paid by you and your employer can be seen as the cost that enables entitlement to pension benefits

Total Reward Statement Login And Support

Nhsbsa pension statement

Nhsbsa pension statement-What a Total Reward Statement includes Your TRS will provide personalised information about the value of your employment package and include details about your remuneration and the benefits provided locally by your employer For members of the NHS Pension Scheme your TRS may also include an annual pension benefit statementIf you are not currently an active member, or if you already in receipt of your NHS pension benefits, you should request this from NHS Pensions using the membership statement request form (SM27A) This can be found in the 'Membership section' of our website We aim to provide you with a statement within 30 working days however this may take longer if we need to request further

2

Total Reward Statements will calculate the basic pension amount for your statement but will not calculate / include the Additional Pension element of your pension If you want an up to date estimate to include your Additional Pension you can request this from NHS Pensions, however this will be chargeable For more information please see the estimate request forms available on ourBenefit pension scheme, which means you get a guaranteed level of benefit at retirement payable according to a fixed formula Pension benefits for all members are calculated using the same method and revaluation rate In a CARE scheme your pension is based on your pensionable pay right across your career The You can view your statement via ESR or online at wwwtotalrewardstatementsnhsuk You will need to register through the site and request an activation code to be able to view your personal statement State pension age calculator The State Pension Age will increase to 66 from October , 67 by 28 and 68 by 46

Views How can I get an estimate of my NHS pension benefits?A Total Reward Statement summarises an individual employee's employment package, including basic pay allowances pension benefits (for NHS Pension Scheme members) Some NHS organisations also provide other benefits included in the statement, such as health and wellbeing programmes learning and developmentMember TRS and Annual Benefit Statements now available 24th August Refreshed Total Reward Statements (TRS) and Annual Benefit Statements (ABS) are now available Read more

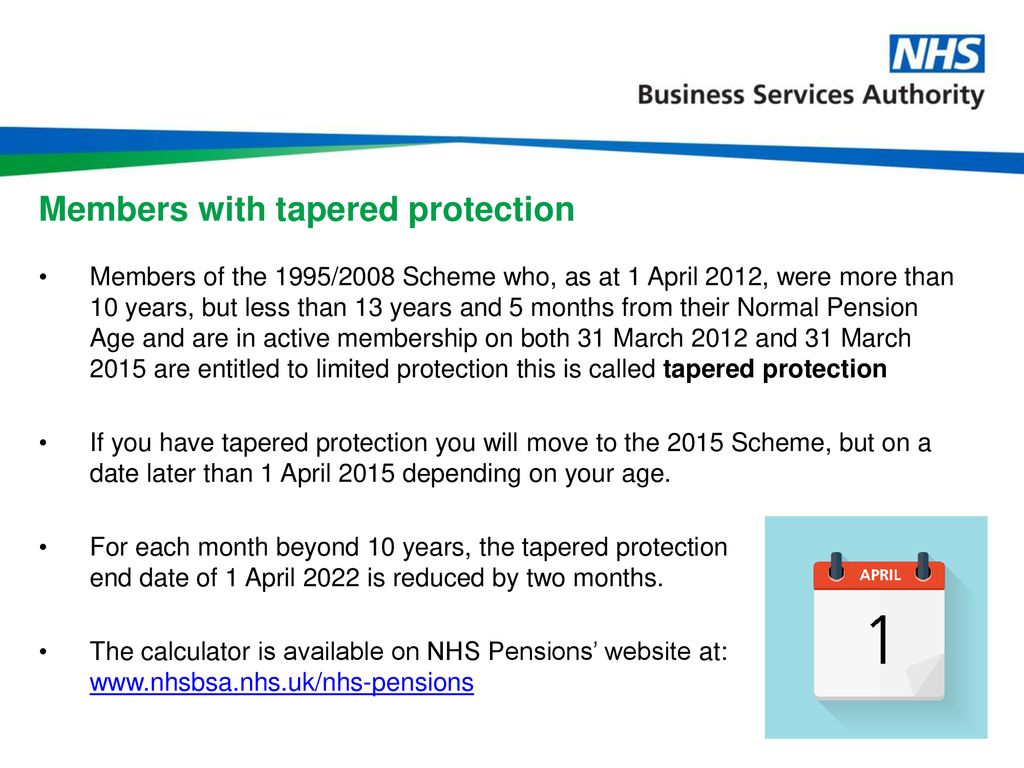

Total Reward Statements Most Popular Articles Where can I find my SD number?You started your NHS employment during the current financial year Statement information is always The NHS pension scheme will not necessarily know if you are subject to tapering and if you are subject to the taper you should request a statement NHSBSA (England and Wales) and the HSC (Northern Ireland) will automatically issue statements if the combined growth between the 1995/08 and 15 schemes exceed the standard annual allowance

2

Nhs Pensions Online Portal Page

Sign in to NHS Learning Support Fund BETA This is a new service your feedback (Opens in a new window) will help us to improve itBenefit statements must disclose the total benefit s earned, the vested accrued benefit or earliest date the benefit will become vested, and an explanation if Social Security or other payments will be subtracted when the benefit s are calculated The law on individual benefit statements took effect in 07 Section 508 of the Pension ProtectionViews How can I get an estimate of my NHS pension benefits?

Retirement Booklet For Members Of The Nhs Pension Scheme Supporting The Nhs Supplying The Nhs Protecting The Nhs Pdf Free Download

Nhs Pension Have You Checked Your Annual Allowance Charge Position Lovewell Blake

The statement will also include important information to help you with any queries and provide you with additional details that you may need to be aware of TRS has been developed and delivered in conjunction with NHS Business Services Authority, the Electronic Staff Record Programme (ESR), the Trade Unions, NHS organisations and NHS EmployersThe NHS Business Services Authority (NHSBSA) is an executive nondepartmental public body of the Department of Health and Social Care which provides a number of support services to the National Health Service in England and WalesIt was created on 1 October 05 following a review by the Department of Health of its "arm's length bodies"It began operating on 1 April 06,This can happen if your pension includes a Guaranteed Minimum Pension (GMP) or is subject to National Insurance Modification (NI MOD) If your pension includes a Guaranteed Minimum Pension (GMP) element, the cost of paying increases is met by our scheme between your GMP age (60 for women and 65 for men) and your State Pension Age (SPA)

Fillable Online Form Psm90 Confirmation Of Personal Private Pension Fax Email Print Pdffiller

Thread By Goldstone Tony On Thread Reader App Thread Reader App

NHS Pensions provides active and deferred members with a Total Reward Statement (TRS)/Annual Benefit Statement (ABS) through an online facility, known as Total Reward Statements (TRS) This service is free of charge and is a faster and more convenient way for you to obtain information about your NHS pension Statements are refreshed annually (based on information supplied byNHSBSA Search Search NHS Pensions February 21 update on government changes to public service pension schemes 11th February 21 Employee section This section is to inform employees about their Total Reward and Annual Benefit Statements Read more Applying for your pension Retirement age, early, redundancy, ill health, flexibleThis service is free of charge and is a faster and more convenient way for you to obtain information about your NHS pension More information on how to register to view your statement is available on the TRS website If you view your statement and it does not include your pension statement please contact NHS Pensions directly on 0300 330 1346

The Uk Pensions Landscape A Critique Of The Role Of Accountants And Accounting Technologies In The Treatment Of Social And Societal Risks Sciencedirect

Sp66qjd1k0hygm

Total Reward Statements Most Popular Articles Where can I find my SD number?Your basic annual practitioner pension is 14% of this total amount 08 section Your basic annual practitioner pension is 187% of this total amount We base calculations on the latest pay and dynamising factors we hold on your record 15 scheme We calculate your benefits using your 'pensionable earnings' from each scheme yearWhat you get from our statements The service is free of charge and is an efficient way to get information about your NHS pension Pension statements refresh yearly, based on information supplied by your employer up to 31 March Find out more on our Total Reward Statement information website Early retirement calculator

A False Claim To The Nhs Is The Only Way To Avoid A Fine Nhs The Guardian

Total Reward Statement Login And Support

From 1 April 22, all those who continue in service will be eligible to do so as members of their respective reformed pension schemes (ieNHS Pensions Scheme Identifier Welcome to our Scheme identifier This tool is designed for members who are currently contributing to the Scheme This tool will help you to identify what type of NHS Pension Scheme member you are and whether the April 15 NHS Pension Scheme changes affected which Scheme you are in The Scheme identifier works3 x pension Option to exchange part of pension for more cash Option to exchange part of pension for cash at retirement, up to 25% of capital value Some members may have a compulsory amount of lump sum 3 x pension Option to exchange part of pension for more cash Option to exchange part of pension for cash at retirement, up to 25% of capital

Retirement Booklet For Members Of The Nhs Pension Scheme Supporting The Nhs Supplying The Nhs Protecting The Nhs Pdf Free Download

Pensions Your Nhs Pension Choice Guide Nhs North Somerset

If you have never contributed to the NHS Pensions Scheme then you will not receive an Annual Benefit Statement For more information about the NHS Pension Scheme and to see whether you are eligible to join the Scheme, please visit the NHS Pensions website You will also normally not receive an Annual Benefit Statement if you have previously contributed but opted out of theThe Electronic Staff Record (ESR) is an integrated HR and payroll system for NHS organisations in England and Wales ESR allows NHS employees to view and maintain their personal information, and develop their professional knowledge Not all NHS Employers offer access to ESR, ask your employer if you would like more informationIf you were an active member of the NHS Pension Scheme for part of the pension input period there will be a pension input amount for the period of active membership and you may need a statement This applies whether your benefits remain deferred in the NHS Pension Scheme, they were transferred out to another scheme or you have retired

Aw8p Form Fill Out And Sign Printable Pdf Template Signnow

Employer Choice Newsletter 11

You are not a member of the NHS Pension Scheme or you are a brand new member (with less than one year's service) If there is no employment information your statement, this may be because Your employer does not use ESR and your employment details are therefore not available; To get a quick estimate of the benefits your NHS pension scheme will provide on any retirement date selected by you, just download our handy calculator It's a Microsoft Excel file and covers the needs of most* members of the 1995 Section, the 08 Section and the 15 Scheme as well as members who have benefits in more than one section orThe NHS Pension Scheme is an attractive benefit for those that work extremely hard in the challenging environment of the country's health service On 1 April 15, some significant changes to the pension schemes offered by the NHS were introduced The kind of deal you get when you retire will depend on when you joined the scheme

2

Bsuh Nhs Uk

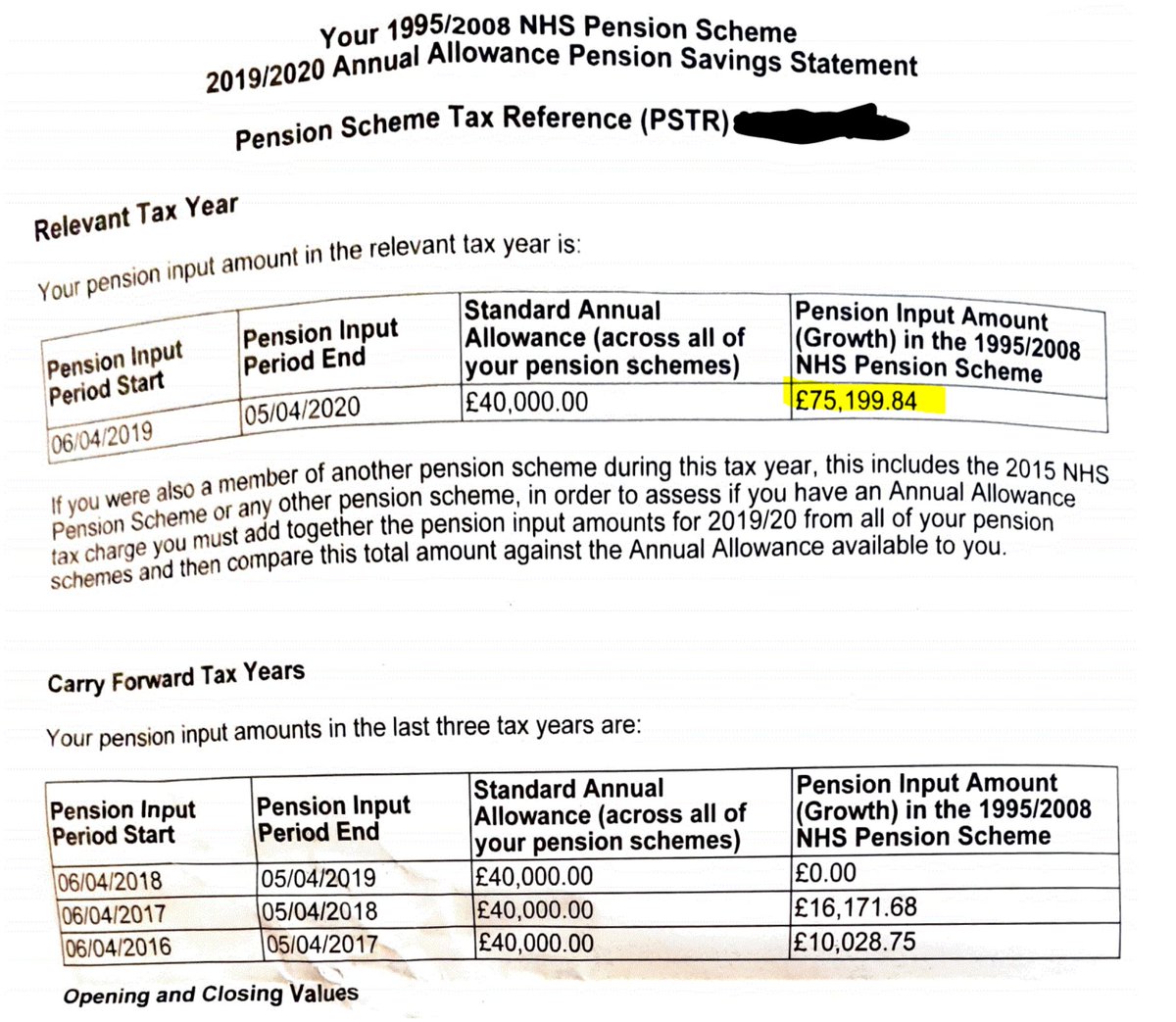

1 Pension Scheme Tax Reference (PSTR) Each NHS scheme has its own PSTR If you have an annual allowance charge you will need this number when you are completing your selfassessment tax return 2 Pension Input Period This is the period over which the growth in your pension savings is measured From We are happy to check your benefit statement on your behalf to confirm this is in order If you are concerned about a particular growth figure included on the statement, you can contract the NHSBSA who should be able to confirm how they have calculated your Annual Allowance pension input growth and what annual pension benefit figures they haveNHS Scheme FAQs What pension scheme will individuals be a member of from 1 April 22?

Nhs Pension Scheme Pre Retirement Ppt Download

Nhs Pensions Online Portal Page

Login » If you have already registered to use the Government Gateway – please click the Login button to access your statement or complete the TRS enrolment process Please note enrolment is a two stage process 1 In stage one you will be sent an activation code in the post (this can take up to 7 working days) 2Make contribution payments to the NHS Pension Scheme Forgotten password Forgotten password Enter your email address and we will send you a link to reset your passwordMake contribution payments to the NHS Pension Scheme This service is for NHS employers Use this service to make payments for your employees contributions your employer contributions adjustments for previous months If you're an administrator, you'll also be able to manage accounts This process will take around 5 mins to complete

New Podcast Live Today Laura Chats Through Some Of The Key Aspects Of The Annual Allowance And Pen Gage Ltd

2

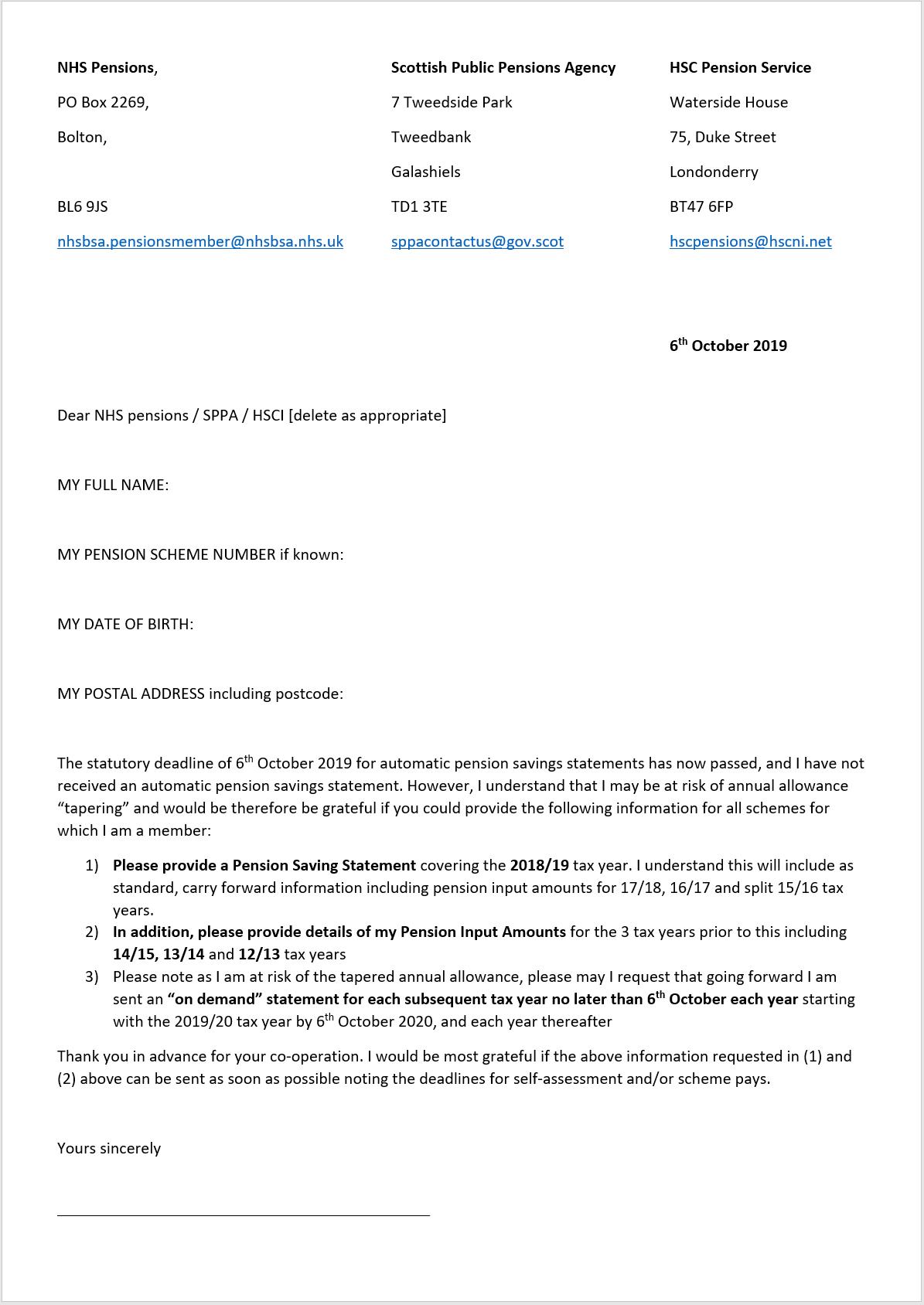

If you are an employed clinician, or a dentist in primary care who is a member of the NHS Pension Scheme, then if your annual pension savings in the NHS Pension Scheme have a value greater than the standard Annual Allowance of £40,000, the NHSBSA will have sent you a Pensions Savings Statement no later than 6 October (providing NHSBSAThe Policy and benefits due under it are guaranteed by NHSEI and the Secretary of State for Health and Social Care They will be administered by the NHS Business Services Authority (NHSBSA) It is a separate scheme from the NHS Pension Scheme The following information explains how you can access the Policy if you are eligible Infographic for GPs NHS Pension Scheme The NHS Pension Scheme is a defined benefit public service pension scheme, which operates on a payasyougo basis A new reformed scheme was introduced on 1 April 15 that

About Total Reward Statements Trs Nhsbsa

2

Knowledge Base Home The Knowledge Base contains numerous support references, created by our support professionals who have resolved issues for our customers It is constantly updated, expanded, and refined to ensure that you have access to the very latest informationPension benefits from the Scheme are calculated using pensionable pay and years and days of membership for members of the 1995/08 Section and using pensionable earnings for members of the 15 Scheme The contributions paid by you and your employer can be seen as the cost that enables entitlement to pension benefitsViews Public service pension scheme consultation response – the McCloud judgment FAQs views What form do I complete to claim my NHS Pension?

The Nhs Pension Scheme England Wales Alan Fox

Total Reward And Annual Benefit Statements Trs Abs Annual Refresh Nhsbsa

Category Customer SelfService NHS Pensions Total Reward StatementsTo benefits including a lump sum and a pension for partners and dependent children Depending on what type of member you are there are also ways you can increase the value of your NHS pension To help you keep track of your NHS pension, you have access to an annual benefits statement or Total Rewards Statement (TRS) via ESR or our TRS webpagesVisit the NHSBSA Increasing Your Pension webpage for more information on all of the options available If you need to submit any forms to us or have a query, you can use the online enquiry form on our website I'm having difficulty accessing my pension statement, could this be due to my pension being under a different surname?

Trs Faqs 15 Revised For Re Launch Doc Total Reward Statements Frequently Asked Questions Q What Is A Total Reward Statement Your Total Reward Course Hero

Nhs Pensions There Are Different Types Of Estimates You Can Request For When It Comes To Your Nhs Pension To Find Out More On What Information You Need And The

Call Drivers Agent Login * 6*** Number Call Stream * Dental Prescription Services Pensions Payroll Pensions Member TRS Pensions Employer Student Bursaries LSF Previous LSF SWB LIS PECS DECS OHS PPC Tax Credit MedEx MatEx NHS Jobs NSDR IHS Healthy Start MHRA Dental Primary * ActivityMake contribution payments to the NHS Pension Scheme Finance login Finance login Login detailsWhat's in your pension savings statement?

The Nhs Pension Scheme England Wales Alan Fox

A False Claim To The Nhs Is The Only Way To Avoid A Fine Nhs The Guardian

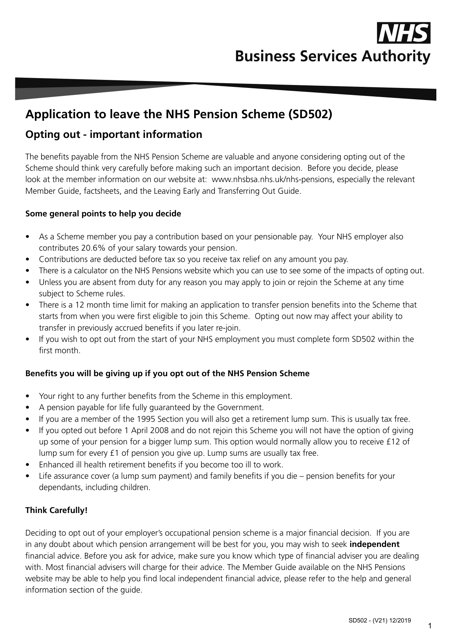

Form Sd502 Download Fillable Pdf Or Fill Online Application To Leave The Nhs Pension Scheme United Kingdom Templateroller

Pensions Taxation Lifetime Allowance Annual Allowance And

Tn17 98 Nhs Pensions Agency Employer Forum Nhs Business

2

Dr Tony Goldstone V Important Its The Deadline For Pension Savings Statement Only If U Exceed Std Of 40k If You Havnt It Doesnt Mean You Are Safe

Statement Of Pensions Policy University Of Oxford

2

Ico Org Uk

Fillable Online Nhs Pensions Change Of Bank Details Or Address Change Fax Email Print Pdffiller

Retirement Booklet For Members Of The Nhs Pension Scheme Supporting The Nhs Supplying The Nhs Protecting The Nhs Pdf Free Download

Pensions Ombudsman Org Uk

2

What Does The Mccloud Judgment Mean For My Retirement j In Practice

30 000 Gps Face Uncertainty Over Pension Tax Risk For 17 18 Gponline

Nhsbsa Nhs Uk

The Nhs Pension Scheme England Wales Alan Fox

Nhs Pension Scheme Pension Flexibility Response To Consultation Gov Uk

Answering Nhs Pension Questions Opting Out How To Claim Moving Abroad Etc Youtube

Ppt Ask Us Powerpoint Presentation Free Download Id

Nhs Business Services Authority Youtube

Sp66qjd1k0hygm

What Type Of Statement You Ll Get Nhsbsa

10 Things You Need To Know About The 15 Nhs Pension Scheme

2

Getting An Estimate Of Your Pension Nhsbsa

Microsoft Customer Story Leading Innovation In The Uk S Nhs

Faqs Nhs Business Services Authority

Guide To The Monthly Pay Statements Dental Services Pdf Free Download

Free 11 Sample Pension Service Claim Forms In Pdf Ms Word

2

Nhs Pension Scheme Pre Retirement Ppt Download

Microsoft Customer Story Leading Innovation In The Uk S Nhs

Retirement Booklet For Members Of The Nhs Pension Scheme Supporting The Nhs Supplying The Nhs Protecting The Nhs Pdf Free Download

The Nhs Pensions Choice Joint Representatives Conference Verity Lewis Rcn Employment Relations Department Ppt Download

Fillable Online Application For Non Domestic Rates Payment Under The Nhsbsa Fax Email Print Pdffiller

Total Reward Statements Employee Section Nhs Business Services Authority Nhs Author What Type

Nhs Pension Explained 1995 08 15 Contribution Basis Normal Retirement Age Benefits Etc Youtube

Nhsbsa Compass Login Information Account Loginask

2

Nhs Business Services Authority Youtube

The Nhs Pension Scheme England Wales Alan Fox

Choice Newsletter 10 Nhs Business Services Authority

8 Key Takeaways The Nhs Pension For Absolute Beginners

Tax Relief On Pension Contribution Page 2 Finance Pistonheads Uk

Nhs Pension Scheme Pre Retirement Ppt Download

2

Form Sd502 Download Fillable Pdf Or Fill Online Application To Leave The Nhs Pension Scheme United Kingdom Templateroller

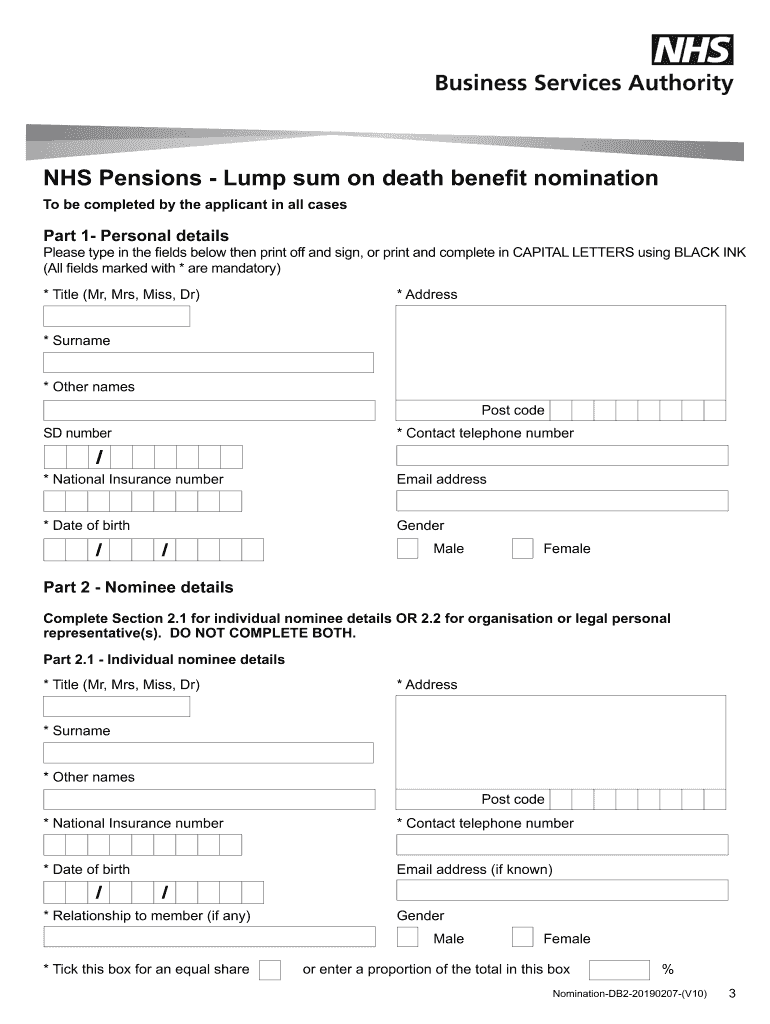

Uk Nhs Db2 19 21 Fill And Sign Printable Template Online Us Legal Forms

2

2

Retirement Booklet For Members Of The Nhs Pension Scheme Supporting The Nhs Supplying The Nhs Protecting The Nhs Pdf Free Download

Www2 Nphs Wales Nhs Uk

Choice Newsletter Nhs Business Services Authority

Ssha Info

Reduced Annual Allowance And The Nhs Pension Scheme Ppt Download

Pension Primer For Trainees Juniordoctorsuk

Summary Of Minutes Of The Nhsbsa Board Meeting Docslib

1

Nhs Kicks Off 4m Digitisation Of Pension Scheme Publictechnology Net

Answering Nhs Pension Questions Opting Out How To Claim Moving Abroad Etc Youtube

Guide To The Monthly Pay Statements Dental Services Pdf Free Download

2

Is Your Pension On Track

Nhs Pension Scheme Pre Retirement Ppt Download

Template 1 Nhs Employers

Nhs Pensions Online Login Login Page

The Nhsbsa Online Pol Guide Pdf Free Download

The Nhs Pension Scheme England Wales Alan Fox

Nhs Misses Deadline For Staff Pension Statements Financial Times

1

Nhs Pensions Nhs Pensions Twitter

Nhs Business Services Authority Prescription Information Statement The Margaret Thompson Medical Centre

Www2 Nphs Wales Nhs Uk

Digital Accessibility Digest Accessibility Statement Pages

0 件のコメント:

コメントを投稿